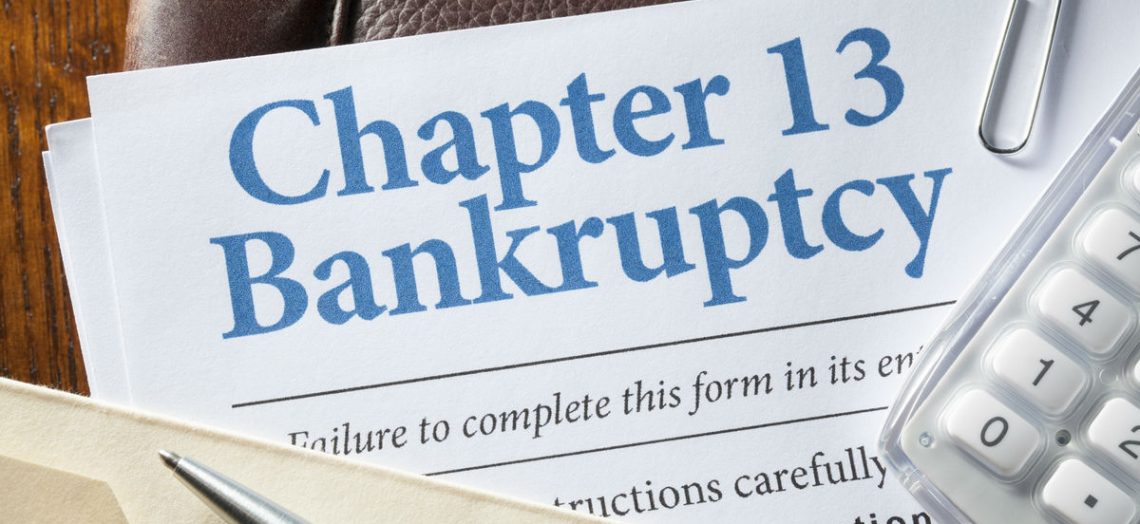

Glory Tips About How To Get Out Of Chapter 13 Early

Secured, unsecured & priority debts in chapter 13.

How to get out of chapter 13 early. Can you pay off a chapter 13 early? Filing for chapter 13 bankruptcy is one option to better manage your debt. The short answer is yes — you can pay off chapter 13 early — but with one condition:

You may be able to. You have four options for terminating a chapter 13 case early, receiving the benefits of a bankruptcy discharge, and walking away: So, you want to get out of your chapter 13 bankruptcy early.

Chapter 13 protects your loan cosigners against collection efforts if the bankruptcy settlement obligates you to repay the debt yourself. You are subject to the timeframe. In most cases, the answer is no.

Learn about four options to end your chapter 13 case early, including converting to chapter 7, paying 100%, getting a hardship discharge, or modifying your plan. To qualify for an early chapter 13 discharge, you’ll need to file a motion for a hardship discharge and show the court that each of these three conditions has been met. That is, you can just voluntarily end the jointly filed case.

Pay 100 percent to all of your general unsecured creditors who timely filed. We've helped 205 clients find. However, you must be well aware.

You have two options for paying off your chapter 13. You might be able to get out of chapter 13 bankruptcy early if you can pay off your debt or you prove a financial hardship. If you need to file a second.

At this point as of january 6th 2021 i am awaiting my 341. If you want to pay your chapter 13 plan off early, you must first write the trustees office requesting a balance to complete letter. What if you pay off your debts early?

Can chapter 13 be discharged early? Find out the benefits and requirements of each option and the risks of terminating your. You can almost always dismiss a chapter 13 case.

Most courts won’t let you end a chapter 13 plan early unless you pay all of your debts in full or suffer a financial hardship. Bankruptcy, chapter 13 | january 23, 2021 | christopher ross morgan normally, a repayment plan bankruptcy in georgia lasts three or five years. A chapter 7 is different in this respect.

You can do so, here is how that works. This chapter of the bankruptcy code provides for adjustment of debts of an individual with regular income. Chapter 13 allows a debtor to.